What is the selection guide?

Our selection aid shows an overview in which you can compare products with each other. This way you can easily see which products are the most interesting, based on the lowest purchase price and the lowest difference between the purchase and sales price. You can see:- The current purchase price

- The sales price (if you sell back immediately)

- The price per gram

- The spread (the difference between the purchase and sales price, or the point at which you break even when the precious metal price increases)

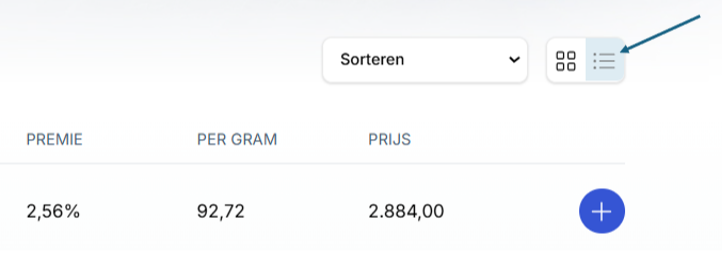

When investing in physical precious metals, the lower the spread, the more interesting the product. You can view the spread directly on each product page by switching to the list view. This gives you quick insight into the price difference between buying and selling.

Discover your golden choice

Gold bars and gold coins

Conclusion for buying gold

Investment gold is exempt from VAT, which means that both gold coins and gold bars are available at a low premium. For private individuals, gold coins are often more attractive due to their worldwide popularity, with the 1 troy ounce as the standard size. The most popular coins are the Maple Leaf and the Krugerrand. Gold bars are interesting for larger purchases, with bars of 50 and 100 grams being the favorite. Large gold bars do offer a sharper price per gram, but less flexibility when selling.

- The most sold are 1 troy ounce gold coins.

- For larger purchase amounts, people often opt for 50 to 100 gram gold bars.

Easily compare silver

Silver bars and silver coins

Conclusion for buying silver

Silver is in principle subject to 21% VAT, as it is considered an industrial commodity. However, silver coins are subject to the margin scheme, which makes them the best choice for private individuals. Pre-owned coins are the most advantageous due to their lower premium and favourable spread. Well-known coins such as the Maple Leaf, Philharmoniker and Britannia are minted in 1 troy ounce of pure silver.

Since 2025, newly minted coins are subject to VAT and no longer fall under the margin scheme, which makes pre-owned or VAT-free silver in storage even more attractive.

- Pre-owned coins or VAT-free silver in storage are the most attractive option

- 1 troy ounce coins are the most common, such as the Maple Leaf or Philharmoniker

- VAT-free silver in storage is interesting for larger purchase amounts

Practical matters when buying gold and silver

When buying precious metals, it is important to take insured shipping and safe storage into account. Silver requires extra attention, because it is much larger in volume than gold. At The Silver Mountain you can pick up your order at one of our locations, have it sent to your home insured by our own courier service or have it stored via Edelmetaal Beheer Nederland. All our products come from recognized producers and are easily tradable worldwide. You can also always sell your precious metal back to us via Inkoop Edelmetaal, where you can count on fixed bid prices based on the most current gold or silver price.Do you have any questions about purchasing precious metals or about our product selection? Please feel free to contact us. We are ready to discuss your questions and offer the opportunity for an exploratory conversation. You can visit us by appointment at our offices in Baarn or The Hague, or contact us by phone for more information.

-ekAgc6qt-dLcPLQf4-small_thumb.png)