Buy platinum

At The Silver Mountain, you have come to the right place for buying platinum. Platinum is a precious metal that has been valued for centuries due to its rarity, durability, and beauty. It is one of the most valuable precious metals in the world.

We offer a variety of platinum coins and bars. Besides platinum, you can also purchase gold and silver online at The Silver Mountain.

Buy physical platinum

You can purchase platinum from us in the form of coins and bars. In the Netherlands, platinum bars are subject to a 21% VAT, as platinum is considered a raw material. For private individuals, it is more advantageous to buy platinum in the form of coins. These coins can be traded under the margin scheme, making them much cheaper as you do not pay VAT on the value of the platinum. Additionally, the market value of platinum coins is significantly higher.

Platinum coins are minted in at least 99.95% pure platinum and come in various popular variants, such as the Platinum Maple Leaf, Kangaroo, Philharmoniker, and the Queens Beasts series from the United Kingdom.

Buying platinum coins

You can purchase pure platinum coins from us in the form of 1 troy ounce platinum and 1/10 troy ounce. Platinum coins are relatively expensive compared to the spot price, partly because platinum coins are traded much less frequently than gold or silver coins. As with gold and silver, 1 troy ounce platinum coins are relatively more cost-effective compared to smaller coins.

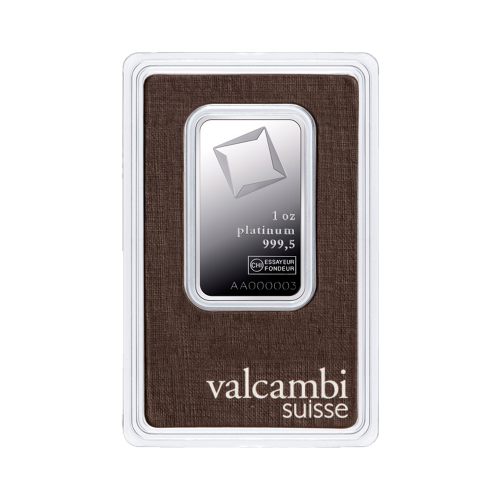

Buying platinum bars

In addition to coins, you can also purchase platinum bars from us. We offer these in combination with storage at Edelmetaal Beheer Nederland (EBN) in the bonded warehouse in Zurich, Switzerland. The major advantage is that you do not pay VAT on your purchase, making it significantly cheaper than if you were to have a platinum bar delivered in the Netherlands.

Buying platinum under a company name

Unlike platinum coins, platinum bars are sold with a 21% VAT. You can purchase platinum from us for business purposes and process the sales tax in your accounts. When selling platinum bars, you can issue an invoice including 21% VAT.

Reasons to buy platinum

Platinum is one of the rarest metals in the world, about 30 times rarer than gold, with a very small total market size. The annual mine production of platinum is very limited, approximately 6% of the annual gold production, and less than 1% of the annual silver production.

Platinum is extensively used in industry. More than 40% of annual production is used in the automotive industry, particularly in the manufacture of clean (diesel) catalytic converters, which help capture harmful substances in exhaust emissions. As emission-reducing elements become increasingly important, more platinum is needed. The demand from the automotive industry is therefore expected to rise.

Besides the automotive industry, platinum is also used in jewelry, accounting for more than 30% of annual production. Around 20% of annual production is used in other industries.

Investing in platinum is on the rise, currently accounting for about 6% of annual mine production.

Investing in platinum

Buying platinum is interesting because the platinum market is very small. In a small market, shortages can lead to significant price increases. Furthermore, it is possible that modern applications for platinum will increase, leading to higher industrial demand and making platinum scarce.

Platinum shortages

A platinum shortage can occur if industrial demand remains steady and supply decreases. Platinum demand is stable because there are often no alternatives and only relatively small amounts are used per product.

Buy platinum online and safely

The Silver Mountain specializes in trading physical precious metals and is a well-known and trusted address in the Netherlands and Belgium. Since 2008, we have been active as a supplier of gold, silver, and platinum, growing into one of the largest dealers in the Benelux with a wide range of physical precious metals. Many platinum coins and bars are available from stock.

We also hold a Trusted Shops certificate, offering 100% buyer protection. You can choose to insure your purchase up to €20,000 with Trusted Shops. In the event we do not deliver, your purchase amount is fully covered.

Buy platinum anonymously

You can purchase platinum anonymously from us through what we call counter sales. If you choose counter sales, you will receive an invoice from us without name and address details. Payment can be made when picking up. Anonymous orders are possible from €2500 and must be placed by phone.

When picking up your order, you can choose to pay in cash or by PIN. You can purchase platinum in cash up to an amount of €10,000.

Selling platinum

At The Silver Mountain, we offer a unique buyback guarantee for the platinum you purchase from us. We will buy back your platinum coins and/or bars at any time, regardless of the quantity or the market price. Thanks to The Silver Mountain's economies of scale, we are the only party in the Netherlands able to provide such a bid guarantee. You can find our current bid prices on Edelmetaal Purchase.

Our customers rate The Silver Mountain an average of 4.8 out of 5 based on over 3,850 reviews.

Is platinum considered a commodity?

Platinum, like silver, is fundamentally regarded as a commodity. As a result, platinum bars in the Netherlands are subject to a 21% VAT.

Should I choose platinum coins or bars?

Given that platinum is considered a commodity, purchasing platinum coins is more cost-effective for individuals. Platinum coins are traded under the margin scheme, similar to silver coins, which means you do not pay the 21% VAT on the value of the platinum.

Alternatively, you can opt for platinum bars combined with storage. By storing the platinum, you can purchase physical platinum without paying the 21% VAT since the platinum is never imported into the Netherlands. Within this depot, you can also easily sell your platinum.

Do I pay VAT on platinum?

Yes, platinum is primarily regarded as a commodity. However, you can choose platinum coins, which are traded under the margin scheme, or platinum bars combined with storage as alternatives.

What are the advantages of buying platinum as a business?

When purchasing platinum for business purposes, you can reclaim the VAT by buying platinum as a company.