Outlook for 2025

Update: 28 January 2025 Reading time: 15 min

After an eventful 2024, we look forward to 2025 with great pleasure. Where we reflected on the highlights of the past year in our last article, we look ahead to what the new year has in store. 2025 brings many opportunities, remarkable changes and innovative steps - both in the precious metals market and at The Silver Mountain.

Below we share the most emerging trends and developments we expect, Netherlands and worldwide.

Dutch Trends: A year of change

Economic recovery:

After the challenges of recent years, the Netherlands is taking steps toward economic recovery. For 2025, De Nederlandsche Bank forecasts economic growth of 1.5%, driven by rising consumer spending and government spending.Households benefit from an increase in purchasing power and low unemployment, which may also stimulate greater demand for precious metals.

Inflation, which is expected to reach 3.2% in 2024, will remain stable at this level in 2025. Although this is an improvement from previous years, inflation in the Netherlands remains higher than the euro area average. A further decline to 2.8% is expected in 2026, which could be a positive development for consumer purchasing power.

High inflation and interest rate cuts by central banks have a lasting impact on the value of fiat currencies.

Inflation reduces purchasing power. Lower interest rates make loans cheaper, which can stimulate the economy. This can result in increased money circulation and a further decline in confidence in fiat currency.

For investors, this economic situation often means renewed interest in precious metals such as gold and silver. These are seen as safe havens. They play an important role in protecting wealth and diversifying investments in times of economic uncertainty.

VAT changes:

As of Jan. 1, 2025, 21% VAT will be charged on new silver coins and coin bars in the Netherlands, making them more expensive for investors. Existing coins produced and purchased before 2025 are subject to the old margin scheme. The Silver Mountain has still purchased silver coins in 2024 and this existing stock can be purchased without 21% VAT via our webshop. While stocks last.

Cash payments:

The limit for cash payments in the Netherlands will be reduced to €3,000 for goods and services, which will take effect in mid-2025. The exact date when this will take effect is not known at this time. This represents a significant reduction from the current limit of €10,000.Amounts above this limit can of course still be paid via bank transfers or other electronic payment methods.

This measure is designed to combat money laundering, fraud and other illegal activities. Limiting large cash transactions will make it easier to track cash flows and address suspicious transactions.

At The Silver Mountain, we remain committed to transparency and safe transactions. Do you have questions about how these new rules may affect your purchases?

Please feel free to contact us!

Business Developments:

Innovation for convenience and safety

In 2025, we are expanding our services to include a new feature within our home courier service: on-site fulfillment of purchase orders. This means you can safely and easily sell your bullion from home. With a test phase and active customer feedback, we will continue to improve this service to provide you with an optimal experience.The Hague office extends it's opening hours

From January 2025, we will extend the opening hours of our The Hague office. This will make it even easier to pick up your purchases by appointment.From January 6, we will be open in The Hague on:

Monday | 10:00 - 16:00.

Tuesday | 10:00 - 16:00 hours

Thursday | 10:00 - 16:00 hours

Friday | 10:00 - 16:00 hours

Our team is available on these days to help you quickly and efficiently. Here are the opening hours of our offices in The Hague and Baarn.

Worldwide trends

Geopolitical tensions:

Precious metals markets remain sensitive to the impact of geopolitical tensions. Global events, such as ongoing conflicts in Ukraine and tensions in the Middle East, will continue to impact gold and silver prices in 2025. In times of political uncertainty and conflict, investors often seek safe havens to protect their assets. Gold and silver are traditionally seen as safe investments in uncertain times.This means that the prices of these precious metals often rise when there are geopolitical tensions.

In 2025, we expect these trends to continue as long as conflicts persist. Still, we especially hope that 2025 will see calmer times and reduced tensions and conflicts. This could bring more calm and peace, allowing the world to experience more stability again.

The Rise of AI and the impact on precious metals

The meteoric rise of artificial intelligence (AI) is affecting not only technology and the economy, but also the precious metals market. AI technology requires increasingly powerful and efficient chips, which is greatly increasing the demand for certain metals. According to research firm Metals Focus, not only gold, but also silver, platinum and palladium will benefit substantially.Although the global economic slowdown has temporarily reduced industrial demand for precious metals, the growth of AI servers and switches could reverse this trend. Silver in particular, which is indispensable in electronics because of its exceptional conductivity, is at risk of becoming scarce due to the combination of AI development and growing demand from the green energy sector. Researchers predict that solar panel manufacturers will consume 20 percent of the world's silver supply as early as 2027, rising to nearly all current reserves by 2050. Gold and platinum, essential for chip manufacturing and circuitry, will also see increasing demand.

With the rapid advancement of AI, the impact on the precious metals market seems inevitable.

Stargate: America's Large-Scale AI Investment

The United States has taken a major step to strengthen its leadership position in AI technology. President Donald Trump recently announced the “Stargate” project, a massive initiative in which technology companies such as OpenAI, Oracle and SoftBank are together investing $500 billion in AI infrastructure. This project focuses on building massive data centers and power plants, particularly in Texas, to support the growing computing power and energy needs of AI.

The first phase of Stargate includes an investment of $100 billion, which will increase to the full amount in the coming years. This initiative is intended to boost the U.S. AI sector while stimulating the economy through technological advances. The growing demand for computing power will in turn increase the need for specialized hardware, which may cause a further increase in the demand for precious metals such as gold, silver and platinum.

DeepSeek: China's Rise in the AI Race

Not only the United States, but also China is moving at lightning speed in the AI industry. DeepSeek, a Chinese AI company founded in May 2023 by Liang Wenfeng, has been quick to position itself as a serious competitor in the market. DeepSeek focuses on developing open-source large language models (LLMs) and recently launched the DeepSeek-R1 model. This model performs at a level comparable to OpenAI's GPT-4, but with significantly lower cost and less computing power required.

One of DeepSeek's biggest successes was the January 2025 launch of their free chatbot app based on the DeepSeek-R1 model. Within a short time, it became the most downloaded free app in the iOS App Store in the United States. This success had a direct impact on Nvidia's share price, which saw a significant drop due to the shift to cheaper and more efficient AI solutions.

DeepSeek's rapid emergence and open-source approach are causing quite a stir in the AI sector. Their innovation may not only intensify competition in the AI industry, but also change the demand for precious metals, as less energy-intensive and efficient AI models may require fewer raw materials.

The explosive growth of AI and the global race between major powers such as the U.S. and China have direct implications for the precious metals market. Initiatives such as Stargate and the breakthrough of DeepSeek highlight how AI is not only revolutionizing technology, but also driving demand for critical commodities such as silver, gold and platinum. As AI continues to transform the world, its impact on precious metals will continue to be a crucial factor in both technological and economic developments.

What will happen to the price of gold in 2025?

Given the current geopolitical situation, the World Gold Council outlines two divergent scenarios for the price of gold in 2025.Central banks expect further interest rate cuts in 2025 as inflation stabilizes around 2% and the economy cools. In 2024, the European Central Bank (ECB) already cut interest rates four times and the Federal Reserve (central bank of America - Fed) twice. Another cut of 1 percentage point is expected for 2025.

In addition, the focus is on Trump and his “America First” policy, which may stimulate the economy. After the election, the US stock market rose 7%, with tech stocks leading the way. Many U.S. companies have shown confidence in his agenda.

Lower interest rates often have a positive effect on precious metals. Because no interest is earned on gold, precious metals lose appeal with higher interest rates. In contrast, interest in gold and silver often increases when interest rates fall.

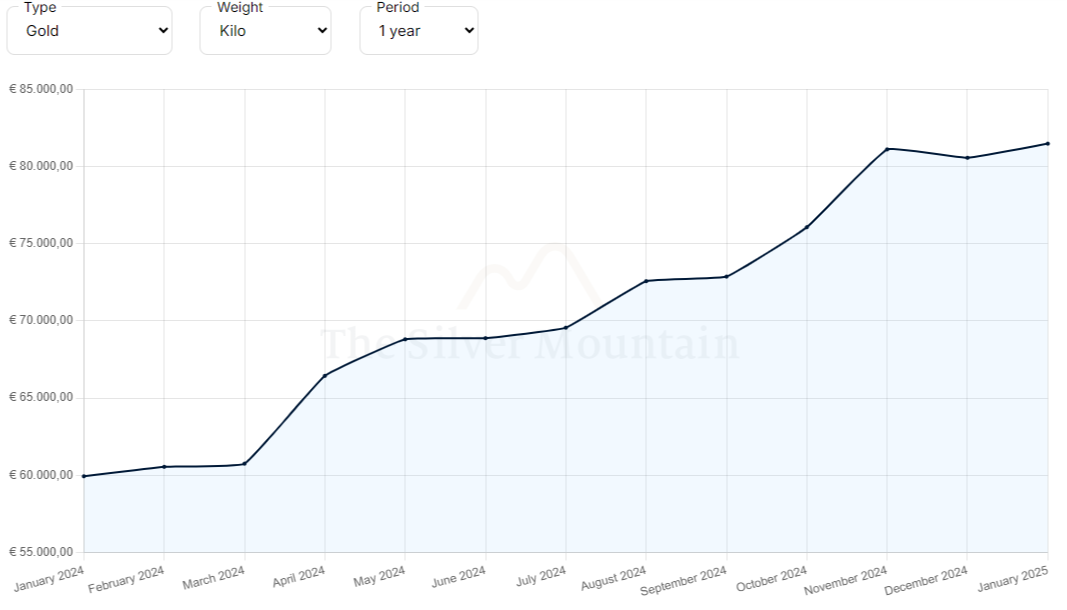

The gold market price in 2024

The silver price in 2025

A growing demand for silver is expected in 2025, mainly due to industrial applications such as electronics, electric vehicles and solar energy. Analysts indicate that this could potentially push the silver price to $36-38 per ounce. In addition, silver may rise due to a declining gold-silver ratio, indicating that silver may be able to outperform gold.The Silver market price in 2024

Sustainability and transparency:

The focus on sustainability and ESG (environmental, social and governance) criteria within the precious metals market continues to grow. Consumers and investors are increasingly demanding transparency and responsible production. This gives companies offering sustainable and ethical products a significant advantage.Stricter guidelines, such as the London Metal Bullion Association's (LMBA) Responsible Sourcing Guidance (RSG), encourage sustainable practices in the industry. This leads not only to innovations, such as cleaner technologies and improved energy efficiency, but also to more responsible business practices. These include minimizing the impact of mining activities, respecting workers' rights and preventing corruption.

Through these initiatives, precious metals production is becoming increasingly sustainable, contributing to a future-oriented market. Moreover, the demand for products that meet ESG standards is increasing, allowing investors and consumers to more consciously choose sustainable solutions.

Technological applications and demand for precious metals in 2025

Gold

Gold remains an essential metal in several technological applications. In electronics, it is used for its excellent electrical conductivity and resistance to corrosion, particularly in connectors and switches. Gold nanoparticles play a crucial role in medical technology, with applications in diagnostic tests and targeted drug delivery. In addition, gold is used in aerospace for coating satellites and space suits because of its reflective properties and protection against radiation. Innovations in electronics, medical technology and aerospace will further drive the demand for gold.

Silver

Silver is indispensable in renewable energy and technology. It is widely used in solar panels, where photovoltaic cells help convert sunlight into electricity. In addition, silver is a key component in electronic devices such as smartphones and computers because of its high electrical conductivity. Silver is also growing in demand in the medical sector because of its antibacterial properties, which are exploited in wound dressings and coatings for medical implants. The focus on renewable energy solutions and technological advances will continue to increase the demand for silver.

Platinum

Platinum plays a crucial role in green technologies. It is used as a catalyst in hydrogen fuel cells, which produce clean energy with water as the only byproduct. In the automotive industry, platinum is used in catalysts to reduce harmful emissions. It is also important in chemical processes, such as the production of silicon for solar panels and fertilizers. The growth of hydrogen technology and stricter emission standards will further increase the demand for platinum.

These technological innovations highlight the crucial role of precious metals in the transition to a more sustainable future.

2025 - New releases: Gold

1/2 troy ounce gold Lunar coin 2025

Explore current offerings >

-8onHqAEb.webp)

1 troy ounce golden coin Britannia 2025

Explore current offerings >

1 troy ounce golden Philharmonic coin 2025

Explore current offerings >

1 troy ounce gouden Maple Leaf munt 2025

Explore current offerings >

Silver

1 kilo silver Lunar coin 2025

Explore current offerings >

1 troy ounce silver Kangaroo 2025 coin

Explore current offerings >

Platinum

1 troy ounce platinum Maple Leaf coin 2025

Explore current offerings >

1 troy ounce platinum coin Kangaroo 2025

Explore current offerings >

Which of these new releases appeals most to you and which would you like to add to your collection?

2025 will be a year where economic opportunity, technological advances and a growing focus on sustainability come together. At The Silver Mountain, we continue to innovate and anticipate the trends that matter. We look forward to working with you to have a successful year!

Do you have questions about these developments or are you curious about what precious metals can do for you in 2025? Feel free to contact us - we are ready to help you!

Disclaimer: The Silver Mountain does not provide investment advice and this article should not be considered as such. Past performance is no guarantee of future results.

Sources:

Belastingdienst. (2025). Wijzigingen in de btw vanaf 1 januari 2025. Retrieved January 11, 2025, from https://www.belastingdienst.nl/wps/wcm/connect/bldcontentnl/berichten/nieuws/wijzigingen-btw-2025

De Nederlandsche Bank. (2025). De stand van onze economie. Retrieved January 11, 2025, from https://www.dnb.nl/actuele-economische-vraagstukken/de-stand-van-onze-economie/

EURACTIV. (2025). ESG requirements are making metals more sustainable, industry says. Retrieved January 11, 2025, from https://www.euractiv.com/section/energy-environment/news/esg-requirements-are-making-metals-more-sustainable-industry-says/

Rabobank. (2025). Kwartaalupdate: koopkrachtherstel laat Nederlandse economie in 2025 en 2026 groeien, en draagt bij aan hogere brede welvaart. Retrieved January 11, 2025, from https://www.rabobank.nl/kennis/d011459365-kwartaalupdate-koopkrachtherstel-laat-nederlandse-economie-in-2025-en-2026-groeien-en-draagt-bij-aan-hogere-brede-welvaart

Rijksoverheid. (2025). Plannen kabinet voor een verbod op contante betalingen vanaf € 3.000. Retrieved January 11, 2025, from https://www.rijksoverheid.nl/onderwerpen/financiele-sector/verbod-contante-betalingen-van-3000-euro

UBS. (2025). Silver: Not everything that glitters is gold. Retrieved January 11, 2025, from https://www.ubs.com/global/en/wealthmanagement/insights/marketnews/article.1613079.html

Van Bruggen Adviesgroep. (2024). Verwachting hypotheekrente 2025, 2027 en 2030. Retrieved January 11, 2025, from https://www.vanbruggen.nl/actueel/nieuws/2024/verwachting-hypotheekrente-2025-2027-en-2030

Over Balder Lysen

Over Balder Lysen

Marketing coordinator at The Silver Mountain