Silver Guide

Update: 20 June 2023 Reading time: 8 min

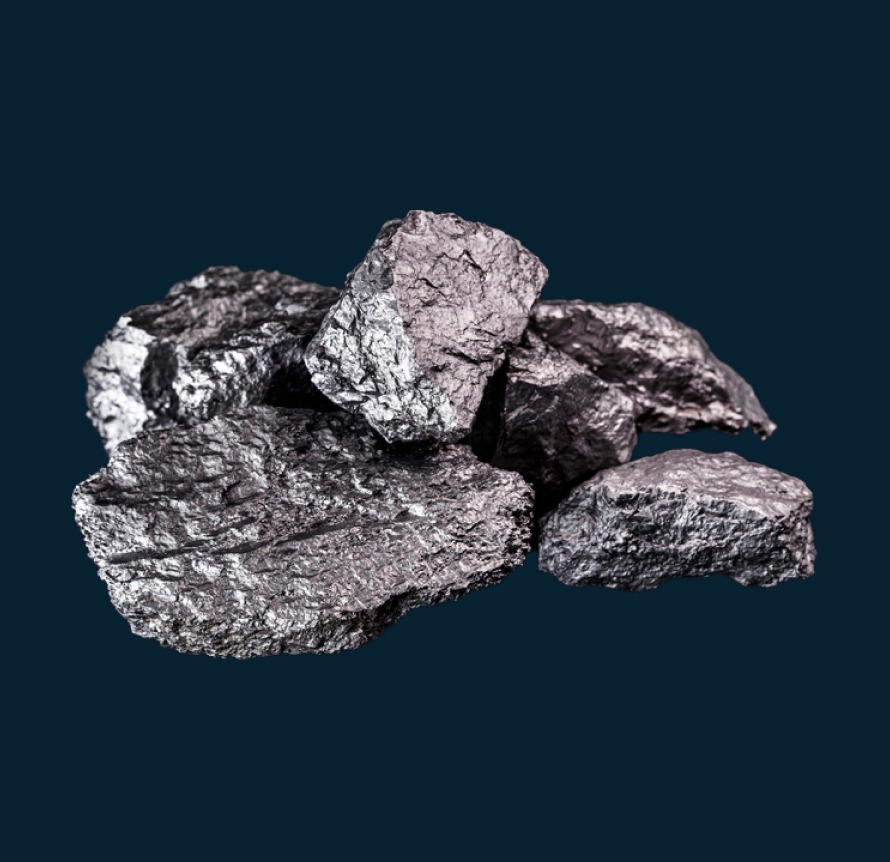

-WSjRldkf.jpg)

History of Silver

Silver goes back a long way. Research has shown that silver was first mined around 3,000 BC in Anatolia, now located in present-day Turkey. The precious metal helped early civilizations in the Near East, ancient Greece, to flourish.Silver production continued to expand worldwide. By the 1870s, production grew from 40 to 80 million ounces per year. New silver discoveries in Australia, Central America, and Europe contributed to the total world production of silver. During the 1900s, new mining techniques contributed to the huge increase in total silver production. Breakthroughs included steam drilling, dewatering mines, and improved transportation. Furthermore, advancements in mining techniques improved the ability to separate silver from other ores and made it possible to process larger quantities of material. This resulted in an increase in world production between 1900 and 1920 by 50%, bringing the total to around 190 million ounces per year.

Over 5,000 years after ancient cultures first began mining in relatively small quantities, silver mine production has now grown to nearly 800 million ounces in 2019.

Gold-silver ratio

The gold-silver ratio represents the amount of silver ounces corresponding to a single ounce of gold. At the time of writing, the gold-silver ratio is 83. This means that with one troy ounce of gold, you can buy 83 troy ounces of silver. Historically, silver is currently (too) cheap compared to gold. If the ratio returns to the historical average, it should fall towards 50:1. The last time the gold-silver ratio exceeded 80 was in March 2016. In the same month, silver began to rise against gold and the metal increased by as much as 17% until July 2016.

Development of the silver price

The silver price, like the gold price, has risen sharply since the credit crisis in 2008. Investor demand for silver increased during this period to secure wealth. However, when we look at the chart below, we see that the silver price has ever been even higher. Where the silver price peaked in 2011, we see that in 1980 the silver price was even higher than then.When we look at silver price increases, we often see that they were short-lived. As hard and fast as the silver price rose, the silver price also collapsed again. This is because the silver market, compared to the gold market, is very small. So it is for easy to influence this price. Central banks have an interest in a structurally low silver price. After all, when the silver price rises sharply, a lot of money leaves the banking system because confidence is very low. Consequently, the large American institutions sell a huge amount of silver in the form of futures. This means a drop in the silver price. However, this quantity of silver exists only on paper, resulting in a shortage of physical silver. This situation, especially in the long term, is unsustainable.

In a study by GATA, the correlation between gold and silver prices and short contracts on COMEX is made unmistakably clear with the help of some simple charts. With the silver price in particular, there is a very clear correlation between the percentage of short positions and the silver price. In November 2008, when the credit crisis was at its peak and several banks had already collapsed, the percentage of short contracts of two banks in America had risen from 9 percent in July to 99 percent in November. Never before had such a huge amount of short contracts been in the hands of just two banks.

Another well-known example is the Hunt brothers. By buying huge amounts of silver, their goal was to influence supply and demand, thereby driving up the silver price to grab returns. In the last nine months of 1979, the brothers profited an estimated $2-4 billion from silver speculation, with an estimated silver supply of 100 million troy ounces.

Buying Physical Silver

More and more individual savers and investors are choosing to convert part of their savings into physical precious metals. Both gold and silver have played a role as real money for 5,000 years and are a proven method to protect and preserve accumulated wealth and purchasing power.

Main advantages of holding physical silver:

🗸 Have your own assets, the metal is within reach.

🗸 Not dependent on a third party, such as a bank.

🗸 Your assets are taken out of the fiat money system and gain tangible value.

🗸 Silver coins could also be used as a medium of exchange or payment.

Nowadays, silver is also used in many different types of devices. After oil, silver is the most versatile raw material and is used in mobile phones, computers, but also in solar panels and batteries for electric cars. More than half of the annual silver production is consumed in various industrial applications. In short, silver is indispensable.

Buying Silver as a Private Individual

As a private individual, you can buy silver in the form of silver coins or silver bars. All variants of these silver coins and bars come from recognized producers and are therefore easily tradable. The content is also clear and is shown on all products. Often this is 99.9% pure silver. This makes it clear to all parties what the value of the silver is.

Coins or bars.

There are differences in the products that you can purchase. There are silver bars and silver coins. The silver bars are indeed cheaper to buy, but they are really much less interesting if you buy silver as a private individual. This is because silver bars are subject to 21% VAT. You cannot reclaim this VAT and cannot charge it yourself when you sell the silver again, resulting in a much higher difference between the buying and selling price than with silver coins.Silver coins are traded under the margin scheme, which means you only pay VAT on the trader's profit margin. In many cases, this margin is relatively limited, for example, 5 or 10%, which means that applying the margin scheme results in only 1 or 2% of the purchase price being VAT for you. The margin scheme can also be applied when you sell the silver (back), making the difference between the buying and selling price much more favorable than with silver bars.

The best choice

Silver coins are always the cheapest option as an individual. This is because silver is considered a commodity and for this reason bars are taxed with 21% VAT. Besides the fact that silver coins are cheaper to purchase, you also get significantly more in return for coins in the future, because you cannot charge VAT yourself.The table below shows this clearly. The calculation example is based on the silver price and bid bonds of September 6, 2023 at 12:00. For the most current spread, please refer to our Selection Guide.

Silver Philharmonica coin | Silver bar 1 kilogram |

| PRICE PER PIECE | €27,05 |

| WEIGHT | 31,103 gram |

| PRICE PER GRAM | €0,87 |

| BUYBACK PRICE | €24,70 |

| SPREAD | €2,35 |

| SPREAD (%) | 9,51% |

The higher the silver price, the smaller the spread (%) becomes with silver coins. This is because the price structure of silver coins contains many elements with a fixed price, regardless of the level of the silver price. With a relatively low silver price, production costs are a fairly substantial part of the cost price.

Difference in price

Depending on market conditions, it may happen that one specific coin type is cheaper than the other, while the weight and content of the silver is identical. This has to do with the fact that not all mints charge the same premium, and sometimes it can happen that we ourselves have purchased a certain coin type on a large scale and received a volume discount in the process. We also pass this on in our sales prices.If you make a selection in the silver coins, we advise you to always choose the cheapest option. The weight, content, marketability and also the redemption prices are the same for all these coin types.

Price Structure

How is the selling price of silver coins determined at a mint? Various factors play a role, including the costs of minting coins, import prices, and VAT rates. The diagram below illustrates how the price of a silver coin is structured. You can find more information here.Price structure of silver coins

| Silver price | 68.2% |

| Premium from the mint house | 10.2% |

| Transportation fees | 0.9% |

| Import VAT | 15.1% |

| Gross margin from the trader/seller | 5.1% |

| Overhead costs | 0.5% |

Repurchase guarantee

The buy-back guarantee means that we can always buy back the silver coins at a fixed formula. Regardless of the height of the silver price or the number of coins you want to sell, we can always buy back at this rate. Based on the current silver price you can easily calculate what you will receive if you want to sell the coins.The repurchase price is determined as follows:

| Silver price per troy ounce | €20.76 |

| Repurchase guarantee: 19% above silver price | €3.94 |

| Buyback price | €24,70 |

Common product selection

The most common orders of silver coins are primarily entered based on available budget. Common purchase amounts are: EUR 2,500, EUR 5,000, EUR 10,000 and EUR 25,000.Scale

All silver coins are priced according to a graduated scale. Every three coins the prices on our website are adjusted to ensure that you can order at the most recent silver price.Sample selection

| PER PIECE | AMOUNT | TOTAL | ||

| 1 troy ounce silver Philharmonica coin 2022 | €30,30 | 100 | €3.030,00 | |

| 1 troy ounce silver Philharmonica coin 2022 | €30,30 | 100 | €3.030,00 | |

| 1 troy ounce silver Philharmonica coin 2022 | € 30,30 | 100 | €3.030,00 |

View our selection guide and receive a personalized offer

How silver is delivered

🗸 Delivered individually in a coin case🗸 Per 20 or per 25 pieces in a tube

🗸 Per 500 coins in a sample box

An exception here is the silver Kangaroo, there the coins go per 250 pieces in a smaller size sample box.

How to store your silver

The coins are best stored in a dry, dark place. We personally deliver all coins in airtight containers, such as a coin case or capsule. The silver investment coins are delivered in tubes that fit 20 or 25 pieces so that the coins can be easily stored. Furthermore, it is of course important to store the coins in a safe place.Possibilities

When you have bought gold or silver as protection for your assets, it is of course also important to keep this investment safe. Arranging a safe storage place keeps your investment safe and also benefits your peace of mind.When you are looking for a safe place to store your gold or silver, there are several safe options to choose from. When making your choice, always consider the cost of any additional insurance or the purchase or rental of a safe deposit box. Ultimately, it is important to make a choice that will give you the most peace of mind.

Common options include a bank vault, home safe, a secret place at home or precious metal storage.

Storage at EBN

If you do not wish to consider this yourself, The Silver Mountain also offers storage options within the Netherlands and Switzerland.How does taxation work?

Silver is initially seen as a raw material. For that reason, silver is usually subject to 21% VAT. An exception applies to silver investment coins, as these coins also have a certain collector's value and may be sold under the margin scheme. We sell all silver coins under the margin scheme.

Margin Scheme

The margin scheme means that VAT is only calculated on our profit margin. If we purchase a silver coin for EUR 10,- and then sell it for EUR 11,- there is a profit margin of 1,-. We must then pay VAT on this profit margin.A condition for applying the margin scheme is that no VAT amount is mentioned on the invoice. Silver bars are taxed by us with 21% VAT. If you buy silver as a private person, we advise you to buy silver coins. This is more advantageous and in addition the difference between buying and selling is considerably smaller. More information about this can be found in our selection guide.

If you, as a private person, sell gold or silver back to us, VAT does not play a role. We will draw up a purchase form for you which states what you are selling to us at what price.

Income Tax

Owning physical bullion is considered an investment for income tax purposes. You must therefore declare this in box 3 for income tax purposes (income from investments and savings).Filing the tax return is your responsibility as a private person. We do not actively provide data to the tax authorities, but the tax authorities can request our records, just like any other company. However, we are not a bank and are therefore not in direct contact with the tax authorities.

How do I know it's real

The Silver Mountain's mission is to provide physical silver in a safe, discreet and reliable manner. In doing so, we have a number of guarantees you can fall back on when you buy silver coins from us.Authenticity Guarantee

The Silver Mountain guarantees the genuineness and authenticity of all products offered. We purchase our bullion from approved producers, such as smelters with LBMA Good Delivery Status. All new bars from these producers typically come with a serial number and sealed packaging. The new investment coins we offer are sourced directly through official distributors of the world's leading mints. These are official coins with legal tender status.

Coins of previous vintages are tested by us upon collection for specific weight, content and condition. Through a special device we also measure to what extent the coin or bar reacts to a magnet. This is different for each type of metal and this test can very easily distinguish real silver from counterfeit.

All new coins are delivered in the original packaging as we purchase them from the coin house. For example, if you purchase a sample box of silver Maple Leaf coins, you will typically receive them in the unopened and original packaging, sealed with the seal from the coin house. If the products are from previous years, they have always been checked for authenticity.

Checking authenticity yourself

We also help you to check the authenticity yourself. If you pick up an order at our office, we also offer the possibility to do so.You can easily check the authenticity of silver in several ways. It is especially important to buy silver through a well-known dealer and always choose silver coins from recognized mints.

Since silver coins are often minted in 1 troy ounce of silver, with the current silver price it is not profitable to counterfeit a coin.

Weight test

A counterfeit silver coin often weighs considerably less than a genuine silver coin. Therefore, by checking the weight, you can already recognize most counterfeits.Acid test

Other methods include an acid test, which can be done if you purchase an acid test kit. Depending on the color the acid gets after the acid comes into contact with the silver, it can be determined if this is pure silver.Sound test

A sound test on silver coins with a content of 70 to 95% should cause a prolonged high-pitched tone. With a dull sound, there may be a different type of metal.Magnetic test

Silver has no magnetic properties and therefore should not respond to a magnet, this too is easy to check.

Receive your silver safely

AFM-License

For offering gold and silver combined with storage, The Silver Mountain holds a license from the Authority for the Financial Markets (AFM). This enables us to offer our customers the opportunity to buy and sell physical gold and silver buy and sell, to store precious metals safely and with low barriers.

The Silver Mountain applied for the AFM license in order to increase the visibility of its professionalism and reliability and to test it independently. As a provider of precious metals combined with storage, we are licensed. Our offer meets the conditions of the AFM which allows us to carry this license. You invest under the supervision of the AFM and can therefore assume that everything is done according to the legal rules.

How is secure shipping arranged?

Shipping of orders is done fully insured and discreetly through specialized courier services. You have a choice of shipping options depending on your order amount.

With our deliveries, you will always be asked for a signature. If you choose to pick up at a service point, our home courier or private courier, an ID check will also be performed. With our home courier, you can also choose a non-personal delivery so that someone else at the delivery address can receive the package. This person must then also show ID and sign for receipt.

Our packages are packaged neutrally and our details as the sender are not recognizable. When picking up orders at our central warehouse, packages from whole other web shops with other types of products are also picked up, to ensure discretion here as well. Moreover, all packages are packed under camera surveillance and all shipments are fully insured.

Disclaimer: The Silver Mountain does not provide investment advice and this article should not be considered as such. Past performance is no guarantee of future results.

Over Daan Wesdorp

Over Daan Wesdorp

Manager Inkoop Edelmetaal | Stocks, cryptocurrencies and precious metals