Platinum Guide

Update: 4 December 2024 Reading time: 10 min

-v0x1FoD0.jpg)

History of Platinum

Platinum goes way back in time. Platinum had been used by the original inhabitants of the Americas for a long time before its first mention is made in the writings of Italian Julius Caesar Scaliger around 1500. Unlike gold and silver, platinum has only been mined for a relatively short time and, of all the precious metals, it is the scarcest.

The properties of platinum

Platinum is a malleable and ductile metal with a gray-white luster that is highly resistant to corrosion by cyanides, halogens, hydrochloric acid, and does not oxidize in air. Because the metal is harmless to humans and does not tarnish quickly, it is very suitable for making jewelry. Furthermore, platinum is highly resistant to high temperatures and is chemically stable. For these reasons, platinum is widely used in industrial processes.

The Spaniards named the metal platino, which means: little silver. They found it in Colombia among the mined silver and considered it an unwanted impurity. Platinum is often found in combination with other metals. The British chemist William Hyde Wollaston was the first to purify the metal and made a lot of money for years from the production and sale of platinum.

Where is platinum found

Platinum is found in a few places around the world, it is very rare and costly to mine. To mine one troy ounce (31.1 grams) of platinum, a whopping ten tons of ore must be extracted, a process that takes about 8 weeks.

How is platinum mined

The term platinum group (PGM) is often referred to. They include ruthenium, rhodium, palladium, osmium, iridium and platinum. This is because they are clustered in the periodic table and are often found together during mining.

Platinum is mined in only a few places in the world. Platinum usually occurs in combination with other metals in the platinum group. Platinum is prepared by dissolving the ore or mineral in king's water. This creates residues that are first removed.

Production of platinum

The image below shows global platinum mining production from 2010 through 2022. About 190 tons of platinum are mined annually. In comparison, 3,100 tons of gold were produced in 2022.

Zooming in further on where platinum comes from, the table below shows that nearly 75% of the world's platinum mining production by 2022 will come from South Africa.

Global mining production of platinum by 2022

| Country | Production in metric tons |

| South Africa | 140 |

| Russia | 20 |

| Zimbabwe | 15 |

| Canada | 6 |

| US | 3.3 |

| Other countries | 4.2 |

| Total | 188.5 |

The total global reserves of metals from the platinum group are estimated to be about 70,000 tons, 90% of which are in the earth's crust of South Africa. It is important to note here that this estimate is about the platinum group (PGM) and not platinum itself.

What is platinum used for?

The silver-white precious metal platinum is a favorite catalyst material for chemists. For example, it is found in car catalysts that clean exhaust gases; this is also a reason for an increase in thefts of car catalysts.

In addition to the automotive industry, platinum is also used in the production of green hydrogen via electrolysis. But platinum also plays an essential role within the medical industry, for example in the fight against some forms of cancer.

Finally, platinum is a ductile, malleable precious metal that is resistant to corrosion and oxidation. For this reason, it is widely used in jewelry.

History of platinum price trends

Historically, platinum has usually been more expensive than gold.. Currently, however, gold is worth almost twice as much, which makes platinum relatively cheap historically. In recent years, the platinum price has fluctuated around $1,000 per troy ounce. The all-time high was in May 2008, when the platinum price stood at $2,100 per troy ounce.

What does the platinum price rely on

Platinum is a precious metal used in a variety of industries, including automotive, jewelry and electronics. The price of platinum depends on market supply and demand, as well as other factors such as geopolitical events and economic conditions.

Industrial demand for platinum causes the price to react strongly to the economic cycle. During down economic times, for example, demand from the automotive sector drops, which also reduces the demand for platinum.

Translated with www.DeepL.com/Translator (free version)

Demand for platinum

Figures from the World Platinum Ivestment Council (WPIC) show that demand for platinum fell from 8.5 million troy ounces in 2013 to 7.7 million troy ounces in 2020. However, due to lockdowns, platinum production was below demand in 2020, so prices recovered quickly after the corona dip in 2020 and 2021.

According to the WPIC, there was an oversupply of 1.2 million ounces in 2021 with total demand of 7 million ounces. The oversupply was expected to reach about 974,000 troy ounces in 2022, however, this is difficult to predict due to the war in Ukraine. This is because Russia accounts for about 10% of the global platinum supply and its loss could have a significant impact on the platinum market.

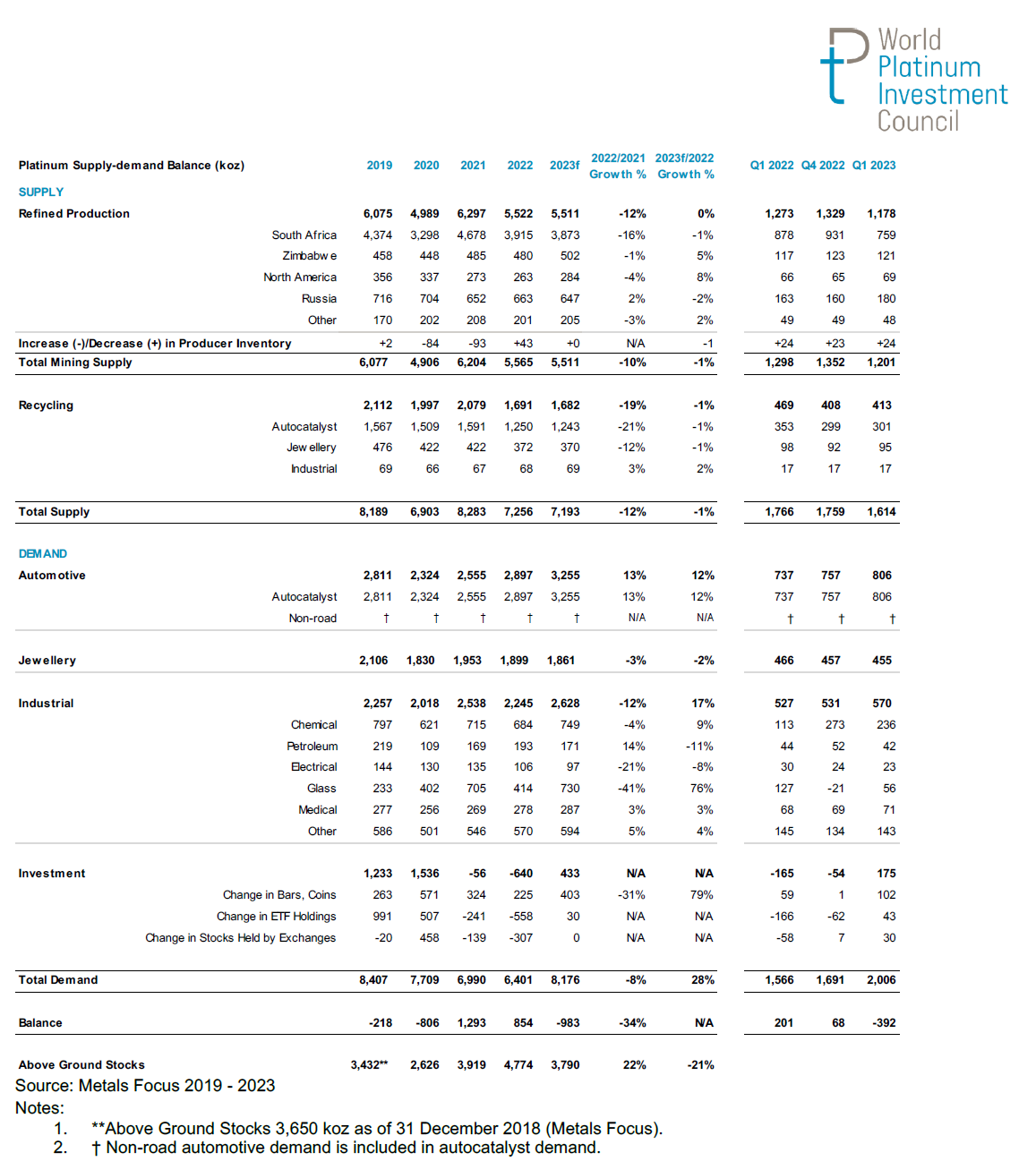

The figure below shows supply and demand figures for the platinum market based on figures from the WPIC.

Buying physical platinum

Coins and bars are traded at higher prices than the current platinum rate indicates (the spot price). This is because there are production costs on top of the raw material value, but also transportation, premium of the mint house and profit margin of the dealer are factors that are passed on in the price. In addition, coin production is less efficient than bar production, making coins proportionally just slightly more expensive compared to bars.

A disadvantage with bars, however, is that platinum, like silver, is considered a commodity and for that reason platinum bars are taxed with 21% VAT. You will also not get this VAT back on a subsequent sale as an individual. An alternative is buying VAT-free platinum combined with storage or buying platinum coins.

Another option is to buy platinum bars on a business basis. You can buy platinum from us on a business basis and process sales tax in your records. When selling platinum ingots, you can prepare an invoice including 21% VAT.

Coins or bars

As with gold and silver, with platinum you can choose between coins and ingots. However, platinum, like silver, is considered a commodity and for this reason, bars are taxed at 21% VAT. Coins, on the other hand, are traded under the margin scheme. The margin scheme means that VAT is only charged on our profit margin. We work with very low profit margins, in practice this amounts to 1% VAT.

Buying platinum as an individual

When you want to invest in physical platinum, you can choose between coins and bars.

As explained above, platinum is considered a commodity. Bars are therefore taxed with 21% VAT, coins on the other hand are traded under the margin scheme, just like silver coins. As a result, VAT is levied only on the merchant's profit margin which makes a significant difference. The profit margins within the precious metals sector actually vary between 1-5%.

So if you are an individual looking to invest in physical platinum, the most advantageous choices are investment coins or bars combined with storage. We will discuss this in more detail later in this chapter.

The best choice

When investing in physical platinum, we always recommend choosing the most cost effective investment coin. This is because should you wish to sell them back to us in the future, we offer 100% of the current platinum price over the net weight of the platinum in the coin or bar in question.

The coins and bars we sell range from 1/10 troy ounce to 1 troy ounce. As with gold and silver, platinum coins of 1 troy ounce are relatively cheaper compared to smaller coins.

Platinum coins from previous vintages are the cheapest choice if you want to invest in platinum. We purchase these coins from private individuals, so we offer these coins at a competitive price.

Difference in price

Platinum coins are relatively expensive compared to the spot price. After all, platinum coins are traded many times less than gold or silver coins, and for that reason it is a much more costly process for mints to mint platinum coins compared to gold or silver coins. The mutual difference in prices is in the premiums of the mints, transportation costs or economies of scale.

We can offer coins from previous years cheaper than newly minted coins. We have purchased these coins through Inkoop Edelmetaal, but we are dependent on sales orders. These coins are cheaper to offer because the production costs have already been paid for a previous purchase.

Price structure

The price structure of coins and bars consists of the intrinsic value of the coin or bar, production costs, transport costs, the profit margin of the dealer and possibly 21% VAT for bars. Platinum coins are relatively expensive compared to gold or silver coins. This is because far fewer platinum coins are produced compared to gold or silver coins.

Platinum in combination with storage

The Silver Mountain also offers platinum bars in combination with storage, this goes through Edelmetaal Beheer Nederland and your platinum is then insured, allocated and safely stored in Zurich in a bonded warehouse. Because these precious metals are taxed with 21% VAT in the Netherlands, it is not interesting to purchase ingots in the Netherlands. However, if you have these ingots stored in Switzerland, it is done in a bonded warehouse and then the metal is not imported into the Netherlands. Thus you save 21% VAT on your purchase amount.

Buy platinum commercially

Platinum bars are sold with 21% VAT. You can buy platinum from The Silver Mountain for business purposes and process the sales tax in your administration. When you sell the bars back to us, you can draw up an invoice including 21% VAT.

Buy-back guarantee

Through our partner Inkoop Edelmetaal, you can offer your platinum back to us at any time. We offer 100% of the current platinum price over the net weight of your platinum.

All our prices are updated every three minutes to reflect the most current platinum price. On our website www.inkoopedelmetaal.nl you can see our bid prices at any time of the day. When you place a sales order, the price is fixed and is a binding agreement. The right of withdrawal does not apply here. If the price rises or falls this has no further influence on the agreement, so the agreed price is fixed at the time you place the sell order.

Disclaimer: The Silver Mountain does not provide investment advice and this article should not be considered as such. Past performance is no guarantee of future results.

Over Daan Wesdorp

Over Daan Wesdorp

Manager Inkoop Edelmetaal | Stocks, cryptocurrencies and precious metals