Change in the gold market over the past thirty years

Update: 17 January 2025 Reading time: 7 min

Over the past three decades, the gold market has undergone extraordinary changes. The structure and dynamics of supply and demand are vastly different from what they were 30 years ago. The Gold Demand Trends, introduced in late 1992, has become an insightful and reliable source of the most comprehensive data and analyses available on the global gold market. In this blog article, we delve into the key changes in the gold market over the past 30 years.

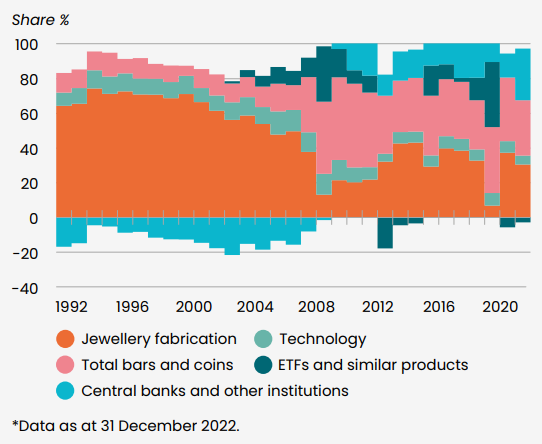

Shift in Demand from Gold Jewelry to Investment Gold

In the image below, the shift in demand within the gold market is clearly illustrated. It highlights the significant transformation the gold market has undergone over the past thirty years from both demand and supply perspectives. In the early 1990s, gold was primarily purchased in the form of jewelry. This changed with the introduction of gold ETFs in 2003 and the financial crisis of 2008. The financial crisis, in particular, triggered a global rush towards physical gold. Gold is regarded as a safe haven asset without counterparty risk, unlike stocks and bonds, which are vulnerable when companies or governments face financial difficulties.

The change in gold market demand since 1992*

Source: World Gold Council

Increasing demand for gold bars and coins

The investment gold market was relatively small in the 1990s. Investments like stocks and real estate delivered high returns, while gold prices were in a downward trend. As a result, investors had little incentive to invest in gold coins or bars. However, this changed due to several key events. For instance, in 1999, gold was exempted from VAT across the entire Eurozone, making it more attractive to purchase gold.

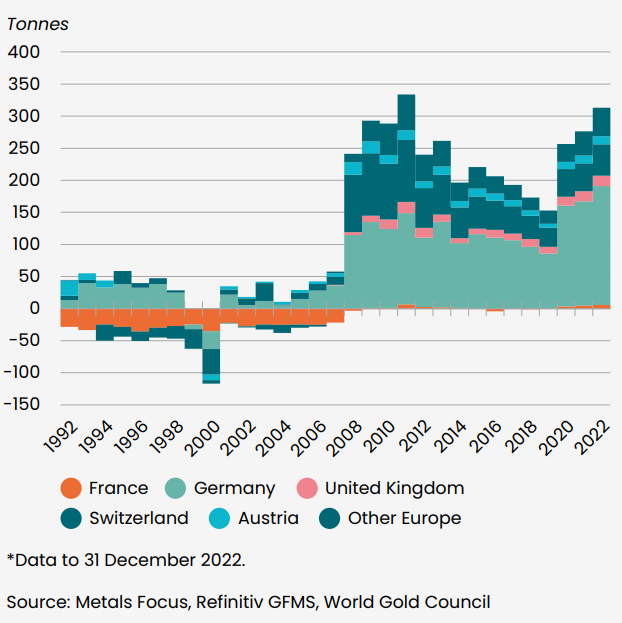

The image below illustrates how the gold market exploded after the financial crisis. As previously mentioned, gold is viewed as a safe haven without counterparty risk. Wealthy individuals began to worry about the stability of the financial system after the 2008 financial crisis and turned to physical gold as a refuge. This demand declined somewhat in the years following the European debt crisis but was reignited by the COVID-19 pandemic and ongoing uncertainties within the financial system. In 2022, as much as 20% of all gold bars and coins were sold in Europe.

Increasing demand for coins and bars since the financial crisis

Source: World Gold Council

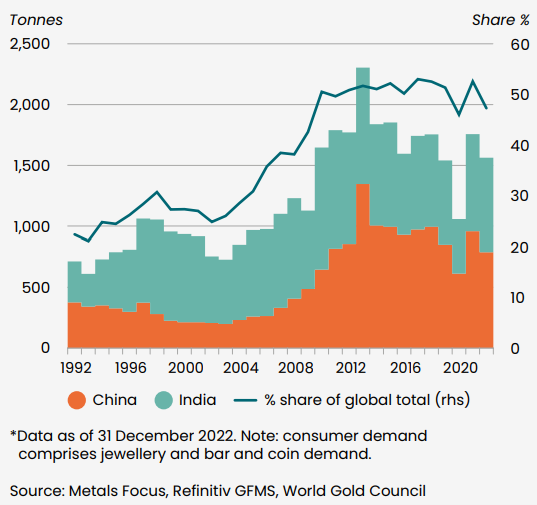

More Gold Flowing Towards Asia

The geographical distribution of gold demand has also shifted significantly over the past thirty years. In 1992, China and India together accounted for approximately 20% of global gold demand. Today, these two countries are responsible for nearly 50% (!) of the world's gold demand. This shift is driven by rapid population growth and increasing wealth in these nations. Additionally, precious metals are culturally viewed in both countries as a form of savings. With the economic growth of recent decades, people had more disposable income, leading to a rising demand for physical gold.

For much of the previous century, individuals in China were not allowed to purchase gold. These restrictions were only lifted in the 1990s, and in 2002, the Shanghai Gold Exchange (SGE) was established, making it easier to trade gold. Since the creation of the SGE, demand for gold jewelry, coins, and bars has quintupled, and since 2013, China has become the largest market for physical gold in the world.

China and India have become increasingly important for the gold market

Source: World Gold Council

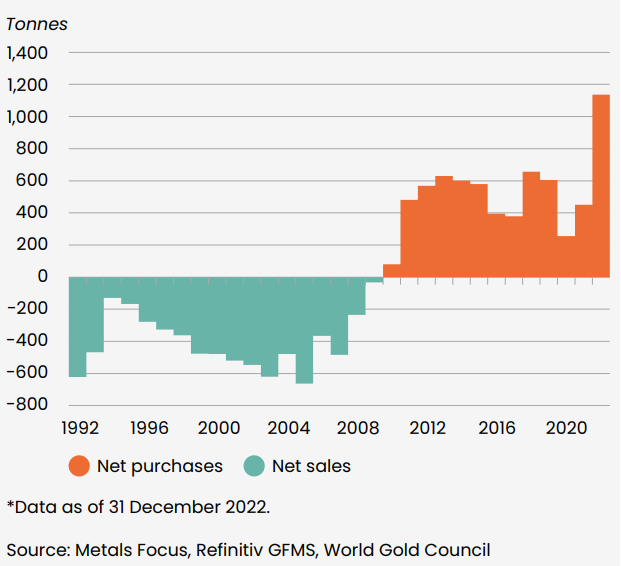

Central Banks Are Buying Gold Again

Another significant shift has been observed among central banks. Previously, central banks were primarily sellers of gold, but this changed after the financial crisis. The sellers were mainly Western central banks with relatively large gold reserves, while the buyers were predominantly emerging economies with smaller gold reserves.

Central banks are buying gold again

Source: World Gold Council

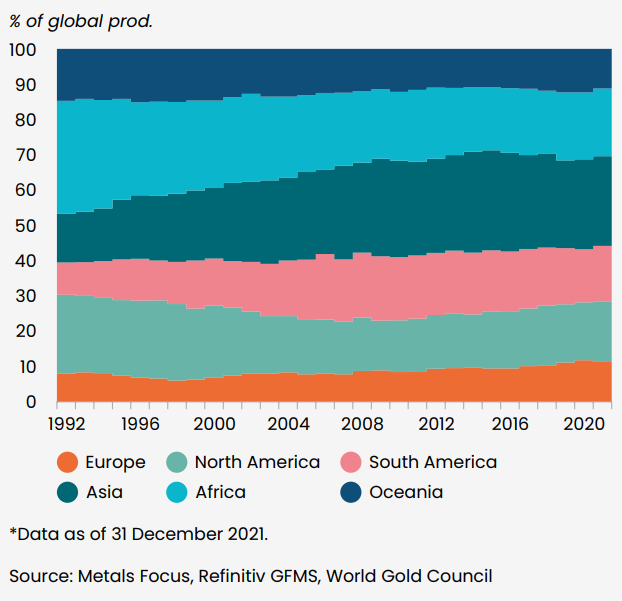

Gold Mine Production More Diversified

Gold mine production has also changed significantly over the past thirty years. More gold is being extracted, and it is coming from an increasing number of countries. Previously, most gold came from South Africa and North America, but the construction of new mines has boosted production in other regions as well. Notably, Asia and South America now account for much more gold production compared to 30 years ago. This geographical diversification contributes to greater stability in the supply of physical gold.

Gold mine production more diverse compared to 30 years ago

Source: World Gold Council

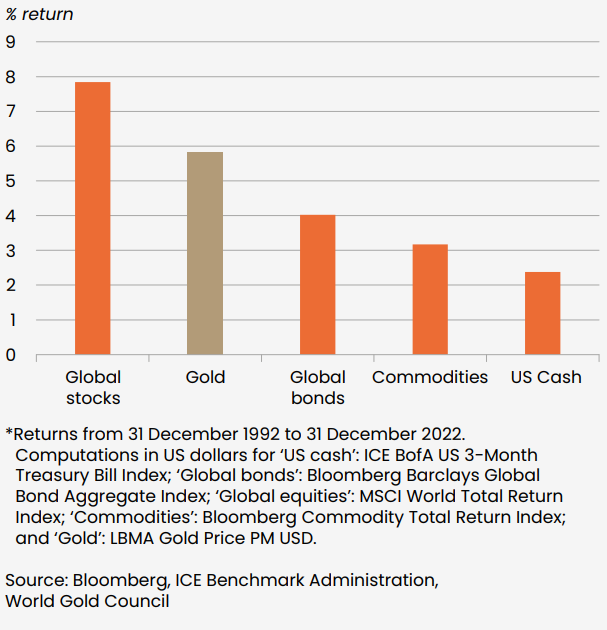

Returns

As mentioned earlier, the market for investment gold was relatively small in the 1990s. Gold was in a downward trend, making it unappealing for investors. This changed around the year 2000. Looking at gold’s returns over the past 30 years, the average annual increase was nearly 6%. While this is less than the returns on stocks, it is higher than the average yield on bonds. Over the past 50 years, the gold price has risen by an average of 8% per year. This confirms that the precious metal maintains its purchasing power over the long term.

Gold returns over the past thirty years

Source: World Gold Council

Disclaimer: The Silver Mountain does not provide investment advice, and this article should not be considered as such. Past performance is no guarantee of future results.

Over Rolf van Zanten

Over Rolf van Zanten

Director and owner

-Psfmhzrc-web_normal.png)