- On sale

- Pre-owned

In stock

In stock

- On sale

- Pre-owned

In stock

In stock

- On sale

- Pre-owned

In stock

In stock

- On sale

- Pre-owned

In stock

In stock

Experienced and reliable

Buying silver at The Silver Mountain

Buy-back guarantee

Buy-back guarantee

Guaranteed buyback with a fixed bid price, regardless of volume or market price.

Trusted for 15 years

Trusted for 15 years

Established in 2008 and now the largest coin dealer in the Netherlands with a customer rating of 4.8/5.

Recognized and respected

Recognized and respected

Silver sourced from accredited producers, minted with at least 99.9% pure silver.

Authenticity verification

Authenticity verification

We guarantee the authenticity of our products and provide a certificate of authenticity with every purchase.

Precious metal guide

Smart investing

Silver is generally considered a commodity and is therefore subject to 21% VAT. If you, as a private individual, purchase silver, it's best to choose silver coins. These coins are traded under the margin scheme, making them much cheaper. You will also receive a better buyback price for silver coins compared to silver bars. In the table below, you can find an overview of the current purchase price, selling price, price per gram, and the spread. The spread shows the percentage difference when you buy silver and then sell it immediately afterward.

Typically, pre-owned silver coins from previous years are the most economical choice, with coins such as the Maple Leaf, Philharmoniker, and Britannia being common options. If you wish to buy larger amounts of silver and have it stored, you can also invest in silver bars, which are free of VAT when stored in a customs warehouse in Switzerland.

Buy silver secure online

When it comes to buying physical silver online, Then Silver Mountain is the right destination. The prices on our webshop are based on the current silver price and are adjusted every three minutes accordingly. Our products are mostly available from stock and are always shipped fully insured. Additionally, we guarantee the delivery and authenticity of your products. This ensures a secure transaction and the best price for you.

Furthermore, you receive a buyback guarantee on the silver you purchase from us. You can always sell your silver back to us at a market-competitive price, regardless of the quantity you wish to sell. We offer the highest bid price in the Netherlands and pay well above the silver value for silver investment coins. Our sister company, Inkoop Edelmetaal, buys the silver coins and silver bars from you.

Why purchase physical silver

An increasing number of individual savers and investors are opting to convert a portion of their savings into physical precious metals. Both gold and silver have served as real money for 5,000 years, and purchasing gold and silver is a proven method to safeguard wealth and purchasing power.

The key advantages of holding physical silver include:

1. Accessibility to your own wealth

2. Independence from third parties such as banks

3. Transformation of your wealth from the fiat monetary system into a tangible, concrete value

4. Silver coins can also be used as a means of exchange or payment in emergency situations

In addition to being considered a safe haven in times of economic uncertainty and serving as a hedge against wealth erosion, silver is a commodity with finite supplies. For years, the demand for physical silver has exceeded the supply. More than half of the annual silver production is utilized in industrial applications, including batteries, medicines, solar panels, touchscreens, 3D printers, and engines. The jewelry industry also requires a significant amount of physical silver annually.

-isMmWIp2.webp)

Unlike stocks and bonds, silver is a tangible asset. When you purchase physical silver from The Silver Mountain, your silver will be delivered to your doorstep by our personal delivery service, or you can collect your silver coins or bars from one of our offices. You will literally have your silver in your hands and full control over it. At The Silver Mountain, you can also buy silver and have it securely stored directly through our sister company, Edelmetaal Beheer Nederland. The silver is stored in your name, and the inventory is audited every six months by an independent accountant.

Silver coins or silver bars

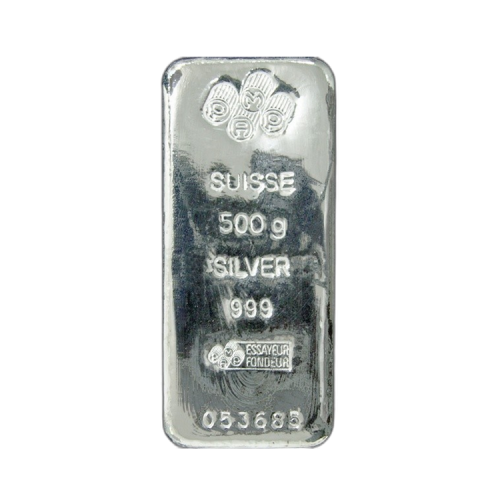

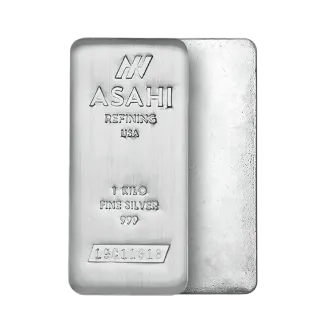

At The Silver Mountain, you can purchase a variety of silver products. The distinction between purchasing silver as an individual or as a business is significant. Silver is considered a commodity, and as such, it is initially subject to a 21% VAT. For business customers eligible for VAT recovery, silver bars present an attractive investment opportunity.

Within the Netherlands, The Silver Mountain is the first dealer to offer silver coins as investment assets to individuals. Silver coins are traded under the margin scheme, making them more cost-effective to purchase compared to silver bars. Under the margin scheme, VAT is only levied on the dealer's margin (profit), rather than the total value. Therefore, it is advisable for individuals to acquire silver coins.

Which silver coins to purchase?

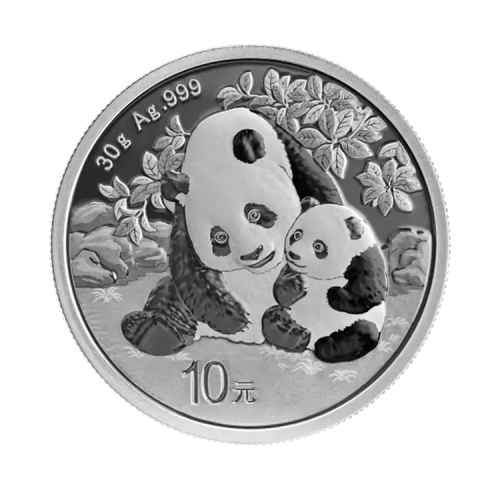

Silver coins vary in design depending on the series, year, and mint where the coin was struck. Examples include the Canadian Silver Maple Leaf and the Austrian Silver Vienna Philharmonic. The investment coins in our assortment are globally recognized and easily tradable worldwide.When investing in silver coins, the design is inconsequential. We recommend selecting the most cost-effective silver coin, as this will provide the highest quantity of silver for your investment. The price per gram for each silver coin can be easily compared on the product page.

Coins from previous years, known as pre-owned coins, are often cheaper to purchase. The silver value of these coins is equivalent to that of new coins.

Furthermore, we offer a buyback guarantee where we do not differentiate our bid prices based on the design of a coin. In other words, we offer the same amount for a Canadian Silver Maple Leaf as we do for an Austrian Silver Vienna Philharmonic.

Purchasing silver in different weights

Silver weight is expressed worldwide in two measures: troy ounces (oz) and kilograms. One troy ounce equals 31.103 grams, and one kilogram corresponds to 32.12 troy ounces.

At The Silver Mountain, we sell silver in various weights. For silver bars, we offer smaller denominations ranging from 100 grams to larger denominations of 1 kilogram, 5 kilograms, up to 15 kilograms. In Europe, denominations of 1 kilogram and 5 kilograms are most common. Larger denominations of silver are highly suitable for investors looking to convert their business assets into physical silver, as they have lower production costs. This results in a more favorable price per gram compared to smaller silver bars.

The most common weight for silver investment coins is 1 troy ounce. 1 troy ounce silver coins were commonly used as a medium of exchange and can still be used in some cases. At The Silver Mountain, we offer many well-known silver coins, from the Krugerrand to the Britannia coins. It is also possible to purchase coins in other weights, ranging from 1/10 troy ounce to 1 kilo coins.

Purchasing silver with cash

Would you like to purchase your silver with cash? This is possible by collecting your order from our offices in Baarn or The Hague. We operate by appointment only and do not maintain stock on our premises.All transactions over €10,000 must be reported to the Dutch tax authorities in accordance with Dutch law. For amounts below this threshold, it is possible to purchase silver anonymously. However, proof of identity may be requested for purchase for inclusion in our visitor register.

You can arrange an anonymous transaction by phone for counter sales. You will then receive an invoice without name and address details, and you can pay the purchase amount in cash when collecting your silver. For cash payments, we charge a 1% administration fee for processing and depositing the cash.

Buying silver as an investment

Investing in silver as a financial asset is increasingly gaining popularity, partly due to its extensive use in various industries. Approximately half of the annual silver production is absorbed by industrial applications such as batteries and solar panels. With production levels on the rise, the demand for silver is significantly increasing, resulting in an anticipated shortage of silver. Consequently, acquiring physical silver becomes an attractive option for investors.

Moreover, silver is increasingly being sought worldwide as an affordable alternative to gold. Similar to gold, silver boasts a rich history as a medium of exchange and has consistently retained a certain intrinsic value. The gold-silver ratio is in flux: historically, gold was 45 to 50 times more expensive than silver, but at the time of writing, gold is approximately 90 times more expensive than silver.

Given the current low interest rates and escalating uncertainties in financial markets, an increasing number of individuals are seeking ways to safeguard their purchasing power. Investing in gold and silver is particularly suitable for this purpose.

Buying silver as a private investor

For private investors, purchasing silver coins is more advantageous than silver bars. Silver coins fall under the margin scheme, meaning that only VAT on the profit margin needs to be paid, unlike silver bars, which are subject to a 21% VAT. Additionally, silver coins are globally recognized, easily tradable, and can, in exceptional cases, serve as a medium of exchange. Silver coins are often minted in smaller denominations than silver bars, making them more liquid and flexible. Investment-grade silver coins of 1 troy ounce are produced in such large quantities (tens of millions per year) that production costs play a limited role.Buying VAT-Free Silver Bars

Private individuals have the option to purchase VAT-free silver bars in industrial quantities by storing the bars in a customs warehouse in Switzerland. Although you do not physically possess the silver bars, you are not required to pay Dutch VAT as they do not enter our country. However, it is necessary for the silver to remain stored in Switzerland. Nonetheless, you can still take advantage of the low premiums and benefit from our buy-back guarantee.Buying silver coin bars

As a private individual, you can also opt to buy silver coin bars. Coin bars are an innovative combination of coins and bars that fall under the margin scheme. By striking a coin in a silver bar, it obtains the status of a "coin," and the entire bar has a nominal value. Coin bars are significantly cheaper for individuals compared to silver bars since VAT is not levied on the entire value.Buying silver as a business investment

For businesses seeking to safeguard their assets, investing in silver, with the ability to reclaim VAT, is appealing. While low interest rates yield minimal returns, the silver price has increased by an average of 8% per year since 2009. Additionally, the silver price compared to the gold price is favorable, making investing in silver a suitable hedge against inflation for businesses. Silver purchases as a business investment are particularly prevalent in the context of a personal holding company.Buying silver coins as a collector

Silver coins are not only issued as investment vehicles, but there are also many silver collectible coins available. Often, they are part of specific series such as the silver Lunar collectible coins or The Royal Mint's Queen’s Beasts series. The coins in these series are produced in limited editions, resulting in higher production costs and consequently, higher prices for the silver coins.

Additionally, there are collectible coins that are issued as standalone pieces and do not belong to a specific series. Such coins are available for only a short period and are issued in very limited editions. Many collectible coins are delivered in gift packaging along with a certificate of authenticity.

Buy silver reliable with buying advice

Purchasing silver is not something everyone does on a daily basis. With over 15 years of experience, The Silver Mountain is here to assist you with personalized advice on buying silver. We recommend starting with our Buying Guide to gather information about different products and compare based on price per gram or spread (the difference between buying and selling prices). You can also reach out to us directly, schedule an introductory conversation, or request a quote.

Our customers consistently rate The Silver Mountain with an average score of 9.6/10 based on over 3,850 reviews.

Frequently asked questions about buying silver

Is it advisable to buy silver?

There are several reasons to consider buying silver. Silver is widely used in various industrial applications, and the industrial demand for silver is expected to increase due to its relative affordability and indispensable role in numerous industrial sectors such as solar panels and medical equipment. More than half of the annual silver production is consumed by industries.

Moreover, many investors monitor the gold-to-silver ratio. This ratio indicates how many troy ounces of silver one can acquire with one troy ounce of gold. A high ratio suggests that silver is undervalued or gold is overvalued. Additionally, like gold, silver has a rich history as a form of real money and is more accessible to smaller investors compared to gold.

What is the price of 1 kilogram of silver?

The current price of silver fluctuates based on global market transactions and is subject to change five days a week, reflecting trading activities on weekdays. Our prices are automatically updated every three minutes based on the prevailing market rates. You can track the price of silver on our website to determine the value of 1 kilogram of silver. At the time of writing, 1 kilogram of silver is valued at over €820.

Since silver is a physical product, the selling price of silver coins and bars includes additional elements such as production costs, transportation costs, and a premium (profit margin) in addition to the value of the silver.

Should I buy silver coins or silver bars?

The choice between silver coins and silver bars largely depends on your personal situation. Silver coins are sold under the margin scheme, meaning that VAT is only payable on the dealer's profit margin and not on the value of the silver itself. Silver bars, on the other hand, are considered commodities and are subject to 21% VAT. For individual buyers, silver coins are the most cost-effective option due to this VAT treatment. However, for business customers, silver bars may be more advantageous as the production costs are lower than those for silver coins, and business customers can reclaim VAT.

What is the best place to buy silver?

At The Silver Mountain, you can purchase physical silver at the most competitive prices in the Netherlands. We are the first dealer in the Netherlands to offer silver coins as an investment option to individuals. Our range of silver products includes silver coins and silver bars.

Should You Buy Silver or Gold?

We are often asked: should I buy silver or gold? This depends on your personal situation, and you need to carefully consider several important aspects such as other investments, your financial position, risk tolerance, and other relevant circumstances.

Silver is becoming increasingly scarce, mainly due to industrial use, and it is hardly ever recycled. Because silver is considered an industrial good, it is subject to 21% VAT, making it particularly attractive for business investors. Silver coins are subject to the margin scheme, meaning VAT is only calculated on the profit margin.

Investment gold is completely VAT-free, so it doesn’t matter if you invest as a business or an individual. Gold is used as a hedge against inflation and to protect purchasing power.

The most common situation is that people buy both gold and silver. The 50:50 ratio is the most popular, but the larger the purchase amount, the more people tend to buy proportionally more gold than silver. This is mainly due to practical considerations since gold takes up less space. Even with a modest purchase amount, it is possible to buy several kilos of silver, whereas gold is much more expensive.

Consult our Selection Guide for a personalized offering of precious metals tailored to your needs and preferences.

Can I Sell Silver Easily?

Almost all products sold by The Silver Mountain come with a buy-back guarantee. You can always offer your precious metals back to us easily, using fixed formulas relative to the current silver price. We always buy, regardless of the volume you sell or the silver price. Selling your precious metals can be done easily, safely, and quickly through our subsidiary, Inkoop Edelmetaal.

Why is One Silver Coin More Expensive Than Another?

Silver coin prices vary. Price differences can occur if mints have increased their premiums or if we at The Silver Mountain have purchased a large quantity of a certain coin type—the discount we obtain in such cases is passed on to you as the customer.

How is the Silver Delivered?

When you purchase silver from The Silver Mountain, you can have it delivered to your home by our personal delivery service. All our couriers are trained to deliver your precious metals safely and discreetly. You can also choose to collect your silver by appointment at our office in Baarn or The Hague.

In some cases, you do not need to take possession of the silver. It can be stored with our sister company Edelmetaal Beheer Nederland (EBN) in the Netherlands or Switzerland. At EBN, precious metals are fully allocated, meaning each bar is registered in your name.

-ATWsvdQP-web_normal.png)