-

Securily packaged

-

Buy back guarantee

-

Tradable world wide

-

Customer rating: 9.7

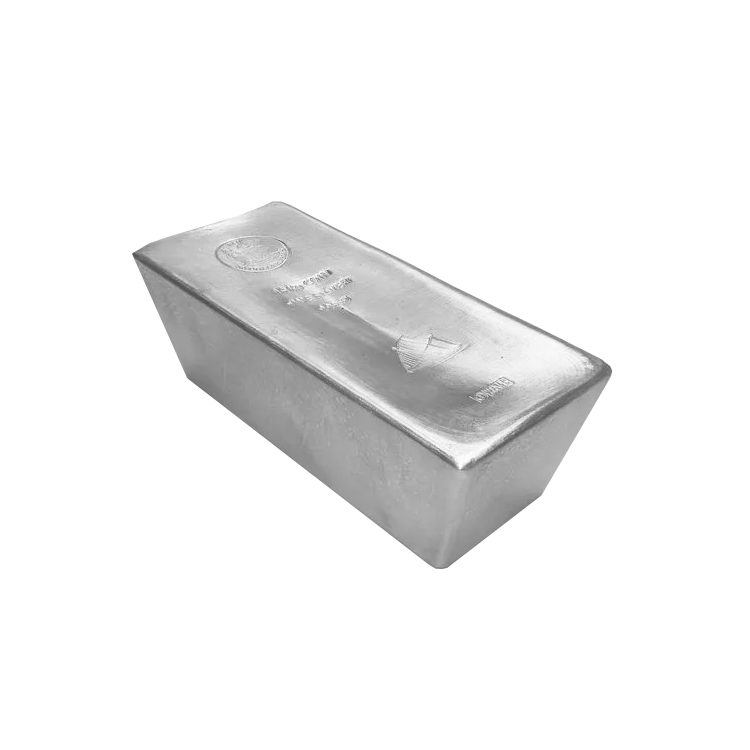

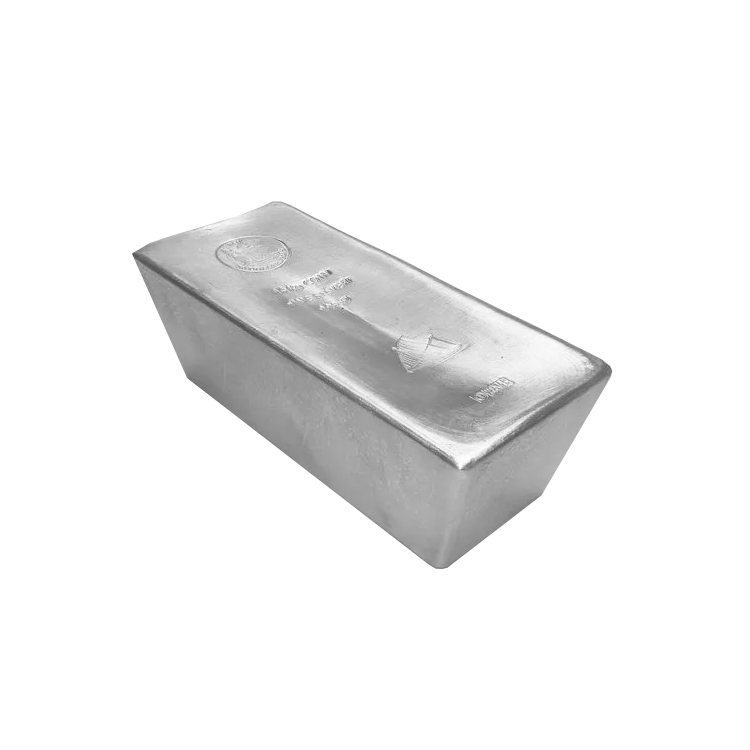

This 15 kilo silver coin bar from Fiji is the largest coin bar minted on behalf of Argor-Heraeus for the Fiji Islands. This coin bar contains 15 kilos of 99.9% fine silver and is traded under the margin scheme, so there is no additional 21% VAT on top of the price.

Specifications

Physical properties

Net weight

The net weight is determined by multiplying the gross weight with with the purity. |

15 kilo |

| Purity and metal type | 99,9% | Silver |

Origin

| Meltery | Heraeus |

Price properties

| Selling price | € 38.696,00 |

| Metal worth | € 31.410,60 |

Price per gram

The price per gram is determined by dividing the sales price by the net weight. |

€ 2,58 |

Premium

The premium is determined by substracting the metal worth from the sales price. |

€ 7.285,40 |

| Investment score | B-label |

| VAT-rate | Margin taxation |

Information

15 kilo silver Fiji coin bar Argor-Heraeus

This is the largest coin bar minted on behalf of Argor-Heaeus for the Fiji Islands. The coin bar contains 15 kilos of 99.9% fine silver. The interesting thing about these coin bars is that they are traded under the margin scheme, because silver is in principle seen as a raw material and for that reason 21% VAT is levied on bars. However, coins and coin bars fall under the margin scheme, which means that only 21% VAT is charged on the trader's profit margin. We work with very low profit margins, in practice this amounts to half a percent of VAT.

Design

On this 15 kilo coin bar you will see the coat of arms of the archipelago with the denomination of the coin bar, the year of issue, the weight and the fineness. In addition, you will also see a sailing ship and the abbreviation of the manufacturer.

Tradability

Argor SA was founded in 1951. After a transfer of ownership in 1986, a joint venture was concluded with Heraeus, among others. Argor-Heraeus SA of Switzerland is accredited by the London Bullion Market Association (LBMA). As a result, this coin bar is on the Good Delivery List, which means that this coin bar can be traded worldwide.

The margin scheme

Silver is seen as a raw material and is therefore charged with 21% VAT. Coins and coin bars fall under the margin scheme and are therefore an attractive option if you want to invest in physical silver. Another option is to buy silver bars in combination with storage at Edelmetaal Beheer Nederland, because they are stored in a customs warehouse, you do not have to pay VAT on the bars.

Featured

- 15 kilograms 99,9% fine silver

- Buy-back guarantee

- Traded under the margin scheme

Price chart

Heraeus

Heraeus is a German international family-owned company and producer of gold and silver bars. Globally, Heraeus is one of the market leaders in the field of precious metals. Heraeus holds the prestigious "Good Delivery Status" from the London Bullion Market Association (LBMA), ensuring that Heraeus bars are widely tradable worldwide. In addition to producing bars, Heraeus is also involved in various other sectors, including precious metals, medical technology, and specialty light sources.

Investment score

Investment score

This product has a B-label (Common bullion coins and bars). This means that it is a common coin or bar that is easily tradable worldwide. However, a product with this label is more expensive than a product with an A-label, so as an investment in physical gold and silver, this product is not the most cost-effective choice. Examples of coins with a B-label are coins with a lower mintage.

Label informationAn A-label means that this is one of our most common products. When purchasing physical precious metals, we advise looking at both the lowest price per gram and the lowest spread. The spread indicates the difference between the buying and selling price. An A-label signifies that this is a favorable choice when buying gold and silver.

B-label means that this is a common coin or bar, which is widely tradable worldwide. However, a product with this label is more expensive than a product with an A-label, so as an investment in physical gold and silver, this product is not the most cost-effective choice.

C-label means that this is a less favorable investment choice compared to a product with a higher investment score. Products with a C-label are considered collectibles.

Price alert

Price alert